In earlier post we had already covered a Fund transfer from Axis to Axis and Axis Bank to Other bank. RTGS is a real time gross settlement which transfer the money at fastest in different bank or locations, Payee can get transferred money within minutes. Axis Bank offers the same when you will make payment more than 2 Lac then NEFT transfer is automatic get converted into RTGS Payment transfer and your transferred money is settled in Real time from one bank to another bank and within the same bank.

By default Axis Bank has set your daily transaction limit that is 50 thousand, you may change your transaction limit from 50 thousand to 5 Lac for making transaction for a specific payee.If you want to make transfer above than 5 Lac then you have to go bank branch for increasing a transaction limit.

Internet Banking facility allows to transfer amounts up to 5 Lac and above 2 Lac transfer process is considered as RTGS Transfer.

Internet Banking facility allows to transfer amounts up to 5 Lac and above 2 Lac transfer process is considered as RTGS Transfer.

You may take a print of a payment receipt or save it in the file or take screenshot of your payment screen, or click to send mail to send the payment receipt in your axis bank mail box.

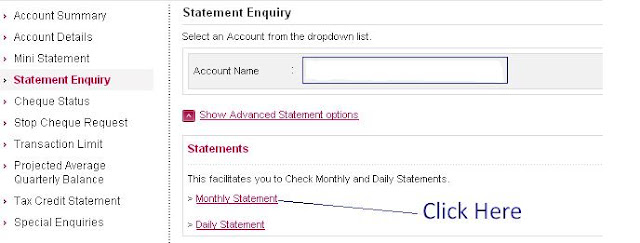

You may check status of your transaction choosing status inquiry button.

Note -:

- When you add an account for transfer, see carefully digits and match the digits twice or thrice time to ensure that the bank account is correct. Do one rupee transfer first to learn the transfer.

- Take Print of your transaction

- Click to send mail to send the receipt in your axis bank online Inbox.

- If it is not printed due to the printer not available then take a print screen of the page as transaction get completed.

- Check status inquiry - you may get the status of your transaction with a RTGS transaction number or NEFT reference number.

- Se transaction limits to less after the transfer.