The income tax department started a service to find out the status of your Income tax refund status. You need to enter Pan Card number and the financial assessment year in which you had filled your income tax return. At the time of the income tax return file if you had provided the ECS option with bank account number and Bank MICR code then refunded money will be credited in your bank account directly and if you had not selected this option then the Income Tax department will be sending a cheque to your given communication address. You may check the refund status online in a simplest way.

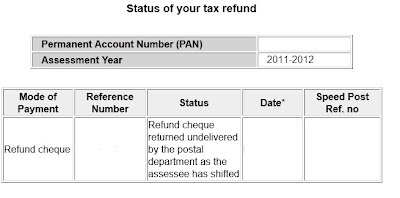

1. If your address is not correct or none has found to receive the cheque at given address then status will be displayed as below -

The income tax department has made tied up with State Bank of India and the bank is called as "Refund Banker", you may ask queries directly to the bank on Toll Free Number 18004259760 and you may write a mail on following E-mail ids -

- itro@sbi.co.in

- refunds@incometaxindia.gov.in

Important Notes :

- Income tax Refund is applicable only to taxpayers if they had filed income tax return at the time.

- Income Tax refund status will be available after an acknowledgement of Income Tax department that they had received your IT return form.

- If Income Tax Refund is calculated by IT department then IT Dept. needs to send refund to a refund banker after 10 days.

- Refund Banker is a state bank of India, so the bank credits refund amount to tax payer's account or sends checks.